Why your Credit Score Matters:

First things first. Obtain a copy of your credit report so you know exactly what you’re working with. Credit scores range from 300 – 850, and represent the value of an individual’s credit history. The higher your number, the more likely you are to receive a loan from a lender. Mortgage companies and banks will look at your credit score to determine the amount of risk that comes along with lending you money. Here’s how your credit score is broken down:

The Credit Score you Need:

Although the federal qualification for an FHA loan is 580, many financial experts recommend working to get your score to 640 or higher before applying for a mortgage. The housing crisis wasn’t so long ago and during that time, lenders found that most people who couldn’t pay their mortgage had a score of 620 or lower. As a result, lenders became a bit more rigid with requirements so although you can certainly get a loan with a score below 640, landing around this figure will reduce the stress of your mortgage process and will ensure a better interest rate.

Improving your Credit Score:

Improving your score comes down to two things: 1.) Having credit and 2.) using it wisely. Taking care of your bills on time shows your commitment to settling your debts and small credit card balances indicate that you do not live beyond your means. You should never max out lines of credit. Never.

If your score is in pretty bad shape, don’t freak out. There’s still hope in a secured credit card, which is a great option for people who can’t qualify for a regular credit card but need to build credit. With a secured credit card, you’ll receive many of the same benefits of a regular credit card but, you’ll be required to make an upfront deposit to get the ball rolling. Your deposit can range anywhere from $200 – $3,000. Whatever you put down will be your limit.

Your Credit Utilization Ratio:

Your credit utilization ratio significantly impacts the 30% of your score that accounts for “amounts owed.” Simply put, it is the amount you owe on your credit cards compared to the limit on those cards. As a general rule of thumb, keep your credit utilization ratio low. ‘Swipe happy’ people who max out their cards are seen as a risk in the eyes of lenders making it more difficult for them to secure a mortgage.

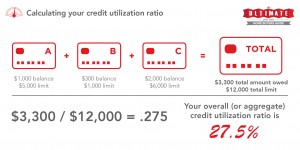

There are two ways to calculate this ratio. Your per-card credit utilization (or line-item utilization) is the amount you’ve used on each card. This is calculated by dividing what you owe on each card by its individual credit limit. So, if you have a $1000 balance on a card who’s limit is $5,000 then your credit utilization ratio for that card would be 20%. You’ll also need to calculate your overall credit utilization ratio (or your aggregate utilization ratio). This is the amount of credit you’re using across all of your cards.

If your credit score isn’t so hot, don’t sweat it. There’s still hope in a secured credit card, which is a great option for those who can’t qualify for a regular credit card but need to build credit.

Credit Score FAQs:

Is one credit utilization ratio more important than another?

Well, not really. They are both important when it comes to getting a mortgage. Having just one of four cards near its limit or maxed out could affect your chances of approval even if your utilization ratios are generally low.

So what should my credit utilization ratio be?

It’s recommended to keep your per card and overall credit utilization ratios at 30% or lower. Keeping your ratio low is no cake walk but there are a few habits you can form that will do your score some good. Check your balances weekly and make payments twice a month. If you’re paid semi-monthly, allocate a chunk of each check to paying down your cards. Yes, it takes discipline and yes, you’ll have to have a few less beers on the weekend. You’ll thank yourself later, trust me.

How long will it take to improve my credit score?

That, of course, depends on your individual score and how much improvement it needs. Generally speaking, it can take anywhere from six months to five years to get your score into the home-buying range. It’s never too late so even if you’re in pretty bad shape, stack a bit of cash, open up a secured credit card, pay your bills on time and keep the faith.

If you have any questions or are looking for a realtor to help guide you through the process, I’d love to help you!

Katie Barreto, Re/Max Signature Homes, 630.310.9449